Model Risk Management for Chief Inspectors, Internal Auditors, CRO’s, CFO’s & ERM Heads. Online-interactive Executive Workshop. 16th July 2021.

Total RegTech Solutions & Qazique Limited are pleased to deliver this programme under the auspices of Risk Management Association of Nigeria (RIMAN) for the betterment of the financial services industry.

Context. For Financial Institutions, Model Governance & Model Risk Management is a critical activity. This an area which is witnessing increased focus and reconsideration due to several factors,

- The economic effects of COVID19 has led to failure of some models. The outcome of which has come to the attention of Boards, Auditors and Regulators,

- The increased number of models with Financial Institutions including them in their decision making,

- Business necessitating faster model development & deployment

- Regulators publishing guidelines and focusing on a higher degree of scrutiny of model governance and model risk awareness.

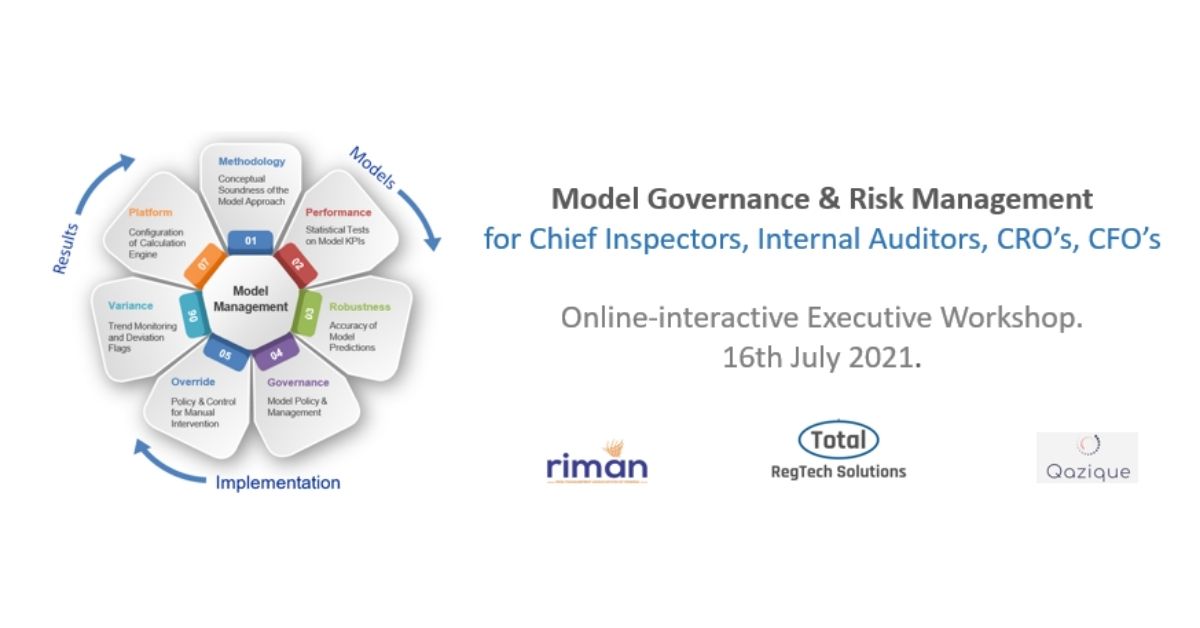

Risk Models are applied in various facets of the business, namely, IFRS9/CECL, ICAAP/Stress Testing, Capital Adequacy, Balance Sheet Analytics, Liquidity Risk, Market Risk, Credit Risk, (Application, Origination, Behavioral Scorecards, Rating Models, PD, LDG, EAD, CCF), CRM, Revenue Management, ATM & Network Diagnostics, Operational Risk, Fraud Monitoring, the list goes on. Models needs to be built more rapidly, calibrated and re-calibrated for accuracy equally fast and more frequently. This creates an inventory of models & results, which needs a governance framework. Such a framework has several stakeholders, the model developer, the review authority, the business team who applied this, the auditor who inspected this, the board risk committee who oversees this, the external auditor and regulatory authority.

Content.

- Regulator’s perspective when auditing Risk Models. Downstream implications for the Institution and Sector.

- Putting this in practice

- Introduction to Model Risk Management (MRM)

- Setting Up the MRM Framework across the Modeling Lifecycle

- Establishing Model Inventory and Model Governance

- Measuring the Model Risk & Model Validation

- Inferences from Models, Interpretations and Communication between Stakeholders

- Successfully Rolling Out and Embedding the MRM Framework

Takeaway from the session. Participants will be able to establish a platform between the stakeholders to achieve the following objectives,

- Bridge the understanding gap as stakeholders come from different qualification, experience, knowledge,

- Communicate to the stakeholder in their perspective, needs & level of detail desired,

- Respond rapidly to internal and external questions and observations,

- Develop and re-calibrate the models faster, more frequently, and more accurately,

- Manage this growing inventory of models, versions, results, descriptions in one place.

Who Should Attend?

Chief Inspectors, Head of Internal Audit, Chief Risk Officer, Head Risk Management, Risk Measurement Head, Head Risk Modelling, Head Enterprise Risk Management (ERM), Chief Finance Officer, Financial Controller. You are welcome to bring in your team members.

Date and Duration.

Duration: One Day

Date: 16th of July, 2021

Time: 10:00am – 3:00pm. West Africa Time.

Venue: Virtual. Details shared upon registration.

Registration Details

Email or call the following persons for registration and more information

- Email info@rimanng.org or call +234 814 241 0241, +234 8083425319 or +234 802 851 6377 @ RIMAN

- Email hussaini.y@qazique.com WhatsApp +234 802 323 6321 @ Qazique

- Email edima.benekpo@qazique.com WhatsApp @ +1 240 906 3161 Qazique

- Email contactus@totalregtechsolutions.com WhatsApp +973 36710300 @ Total RegTech