A steady Inflow of Principal and Interest (Profit) is the fuel needed to keep a Lending Institution in business. Debt Collection is at the heart of this. It is without doubt that in present circumstances a $ recovered is perhaps as or more valuable that a $ of new business.

Quite often, Organisations end up creating overheads which affect this vital function. These are clearly visible in manual operations, delayed task creation based on the call disposition, delayed updating of the payment status, manual account allocation, inability to track field staff, communication gaps between the teams; tele-callers, field staff, management, operations etc.

The clock starts at ‘T+0’. In proactive debt management, tasks start on the date an invoice or bill is issued, not after 30 days!

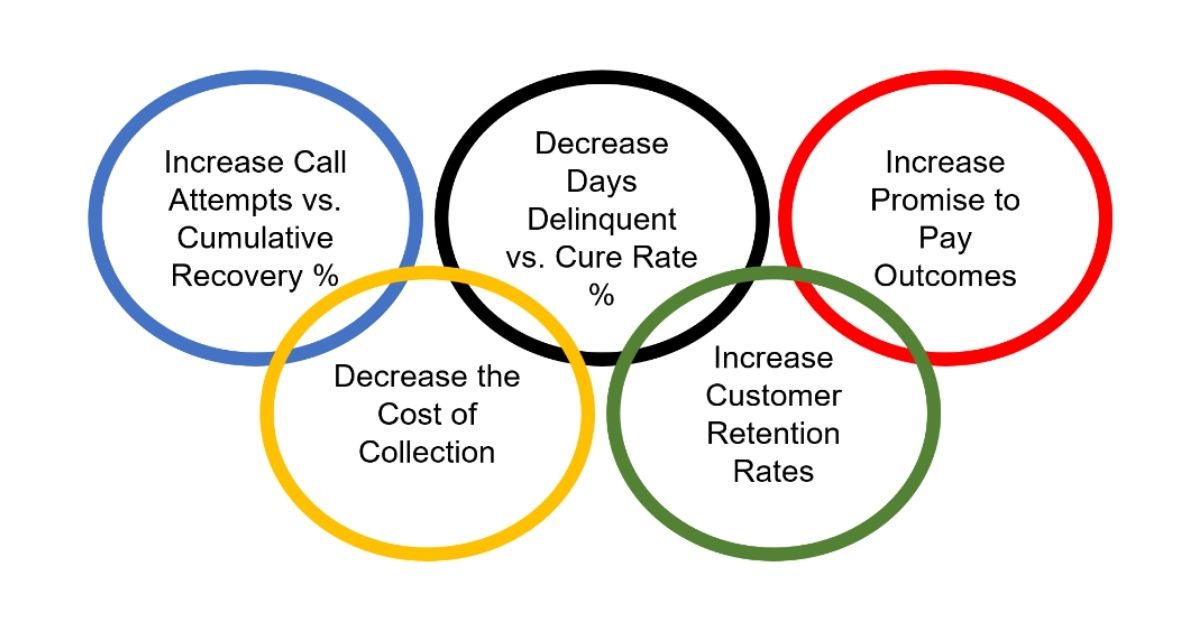

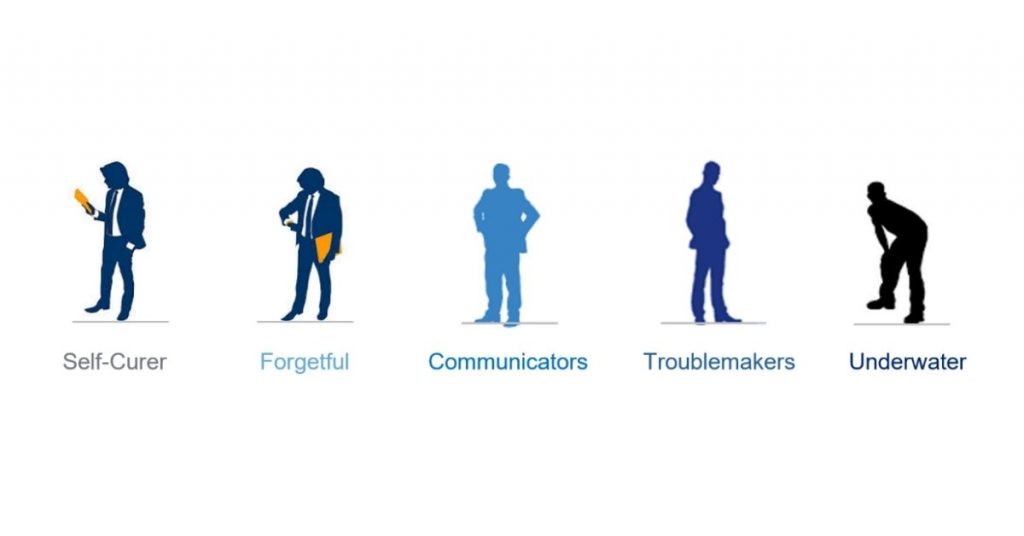

Second, and no less important, how do we recover the amounts without haemorrhaging future good customers, or create bad customer sentiment?Put your Strategy to Action. Debtors vary in many ways. ENCollect allows you to segregate and treat them differently based on their characteristics

Effective communication has been proven to improve debt collection rates exponentially. ENCollect Communication Module automates and enhances communication between the Organisation and their Customers, creating personalized engagement, and commences this activity before you can say “Invoice delivered”! In the build-up to 30 DPD, and thereafter enroute to ‘NPA’, ENCollect communicates with Customers through various channels, Email, SMS, WhatsApp, Facebook, Twitter, Voice Recordings depending on their preference with a gradual build-up in intensity and urgency of the message.

Energize your collection efforts by enabling your personnel in office and on the field with access to all the information… a 360-degree view of the Customer, record trails, disposition status, payments etc. to be able to personalize each contact with the Customer and follow up on the debt. Allocate cases dynamically, allowing you to make course corrections mid-week or on an adhoc basis. Do you have a complex allocation strategy? No problem there too. You can configure these strategies in ENCollect with just mouse clicks. Say goodbye to confusion, as your manager, your colleagues in back-office operations and those telecalling, use exactly the same screens and have the same information, real-time. Use the browser in your office, or the mobile when on the move, with the same user experience. Internet connection dropped, no worries, you can continue working.

ENCollect Voice Assistant pulls up the case details without the need to type. Geo-location Services allows you to mark the last contact point of the Customer & plan your daily route optimally with PTP prioritisation. Voice and Video Calling Services allow you to add a personal touch, understand face and body language, and collect from home. Record them for audit and training purpose.

Allow your field staff to take immediate decisions. Based on your debt recovery strategy, ENCollect allows you to configure and make available a selection of pre-approved loan restructure options.

Send payment links on the fly, receive money through a variety of channels, may they be bank transfers, payment gateways, e-wallets, for part or full payments, giving you the capability to absorb every last $ outstanding. Collect cash responsibly, by directing Customers to geo-safe cash collection points who are fully equipped with Security and PPE kits. Send e-receipts instantaneously, eliminating opportunities for fraud. Auto reconciliation saves your month-end ‘hustle’ for surpassing the targets rather than getting buried in operational hassles.

Plan and operationalize your Incentives Plan, manage Agency Contracts, the Legal and Write-off process all in ENCollect.

Monitor progress by product type, customer segment, region, staff, in the ENCollectReal-time Dashboards. Create different dimension views to suit yourneeds with a few mouse clicks.

With ENCollect you can truly energise your Organisation’s Collections. Roll it out in your organisation within weeks using our Cloud Offering or install it in your Data Centre.

Co-authored by Shobhit Prakash, Lead Evangelist, Sumeru Enterprise Tiger & Kapil Raghavan, CEO, Total RegTech Solutions.

Keen to know more, write to us at contactus@totalregtechsolutions.com or WhatsApp us on +97336710300