Understanding your Customer is a fundamental tenet of lending and credit business. We may be under the impression that we know our Customer(s) quite well, however Decision Science challenges that impression with hard evidence which can surprise. The important question is, “how do we corroborate and improve on our experience & judgment, with facts?”

Therefore, we need to simulate customer behaviour to challenge our ‘personal constructs’. This is done using behaviour scoring metrics which quantify Customer’s behaviour. This not only helps the debt recovery effort, but also helps the Institution better understand its Customer’s and effectively respond to their individual needs. What we aim to achieve from this is a forward-looking ‘Propensity to Pay’ outcome i.e. the likelihood that a borrower will be able to meet his/her payment obligation and importantly this is done on and individual borrower / account level. This differs from ‘Probability of Default’ which can be built upon to achieve the desired result.

An Institution would start by deriving a Collections Scorecard for each Customer. This has elements of the Customer Attributes, Behavior with us, Behavior with others and Macroeconomic indicators, each of which is sensitized into the overall Score.

The following illustration explains what we would infer from such an exercise i.e. the behaviour observed in the collections process and results. The recovery obtained saturates after a certain time window and call attempts, which tells us whether we need to spend time and money on further attempts. We can also see the relation between macroeconomic variables and recovery rates. This is important to factor in the Scorecard to cater to the changing economic scenarios.

It is crucial for any Institution to recognize that Customer repayment capabilities & willingness may change over time and the Institution will need to measure this on an on-going basis in order to adopt appropriate strategies or to offer required support throughout the relationship.

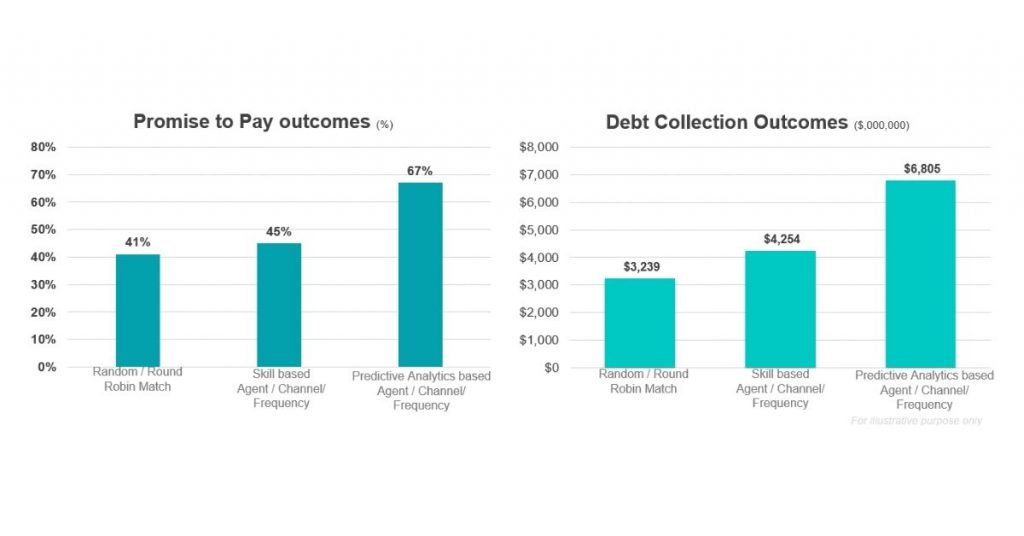

In the debt management practice, the prioritization of accounts for collections plays an integral part in managing bad debt, knowing who to prioritize and thereon optimize the Institution’s collection resources. How frequently, by whom, and through which channel to contact them can be a difficult balance to strike, getting it wrong can potentially cause a negativeCustomer experience, and for the Institution’s ability to recover debt.

In the traditional Collections process, Lending Institutions would segregate Customers into a few risk categories, based either on delinquency buckets or on simple analytics, and assign Customer-service Teams accordingly. Contact strategies and treatment offerings are fairly varied across the risk categories. Institutions now move to a deeper, more nuanced understanding of their at-risk Customers. With this more thorough picture, Customers can be classified into micro segments and more targeted, and effective interventions (Agent, Channel Frequency/Timing) can be designed for them.

With a strong collection analytics framework, the Debt Recovery Function in the Institution, ceases to be a Cost Centers, rather, they become Profit Centers that drive improvement in Customer Experience and Net Promoter Scores. The results can surpass expectations.

By applying Decision Science in the debt recovery process, Financial Institutions can identify the most promising contact channels, while also developing digital channels to define innovative and regulatory-compliant contact strategies. Most Institutions use heuristics to establish the best times to call. Usually, however, Staff/Agents are inadequately supported on questions of which channel to use, when to use it, and what the message should be. Decision Science can project a full channel strategy, including channel usage, timing, and messaging. Lending Institutions will be able to control contact down to the hour and minute, as well as the sequence of communications; including calls (in person and over the phone), text, email, letter, interactive voice message, social media etc. The approach is developed that maximizes the Right-Party Contact Rate (RPC-R) and influences customer behavior to prioritize payment. Such optimal contact sequencing can increase success in early stages of delinquency.

AVRA Scorecard Manager™ provides Lending Institutions the self-service capability to use an intuitive graphical user interface to design, validate, and recalibrate Collections Scorecards, Segmentation and Contact Strategies. Apply these in your Automated Collections Processes using ENCollect™ to multiply debt recovery results.

Co-authored by,

Vishal Jhunjhunwala, Head MEA, Sumeru Enterprise Tiger. He can be reached at vishal.jhunjhunwala@sumerusolutions.com

Kapil Raghavan, Chief Executive, Total RegTech. He can be reached at kapil@totalregtechsolutions.com