Research & Resources

Proactive Debt Recovery & Non-Performing Loans Management For Financial Institutions

Total RegTech Solutions, Regtech Africa Media and FITC are pleased to deliver this online interactive programme under the auspices of the Central Bank of Nigeria. This programme will provide participants with an understanding of the most effective approaches to Debt Recovery, Stage Movement & NPL Control. Scheduled for the 21st

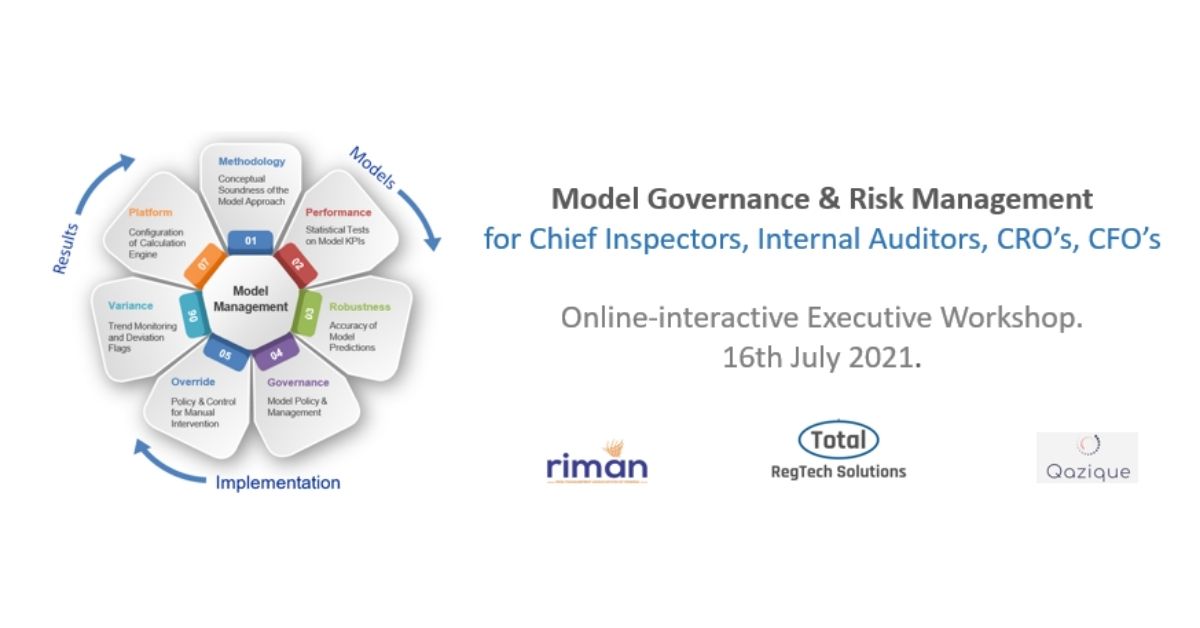

Model Governance & Risk Management

Model Risk Management for Chief Inspectors, Internal Auditors, CRO’s, CFO’s & ERM Heads. Online-interactive Executive Workshop. 16th July 2021. Total RegTech Solutions & Qazique Limited are pleased to deliver this programme under the auspices of Risk Management Association of Nigeria (RIMAN) for the betterment of the financial services industry. Context.

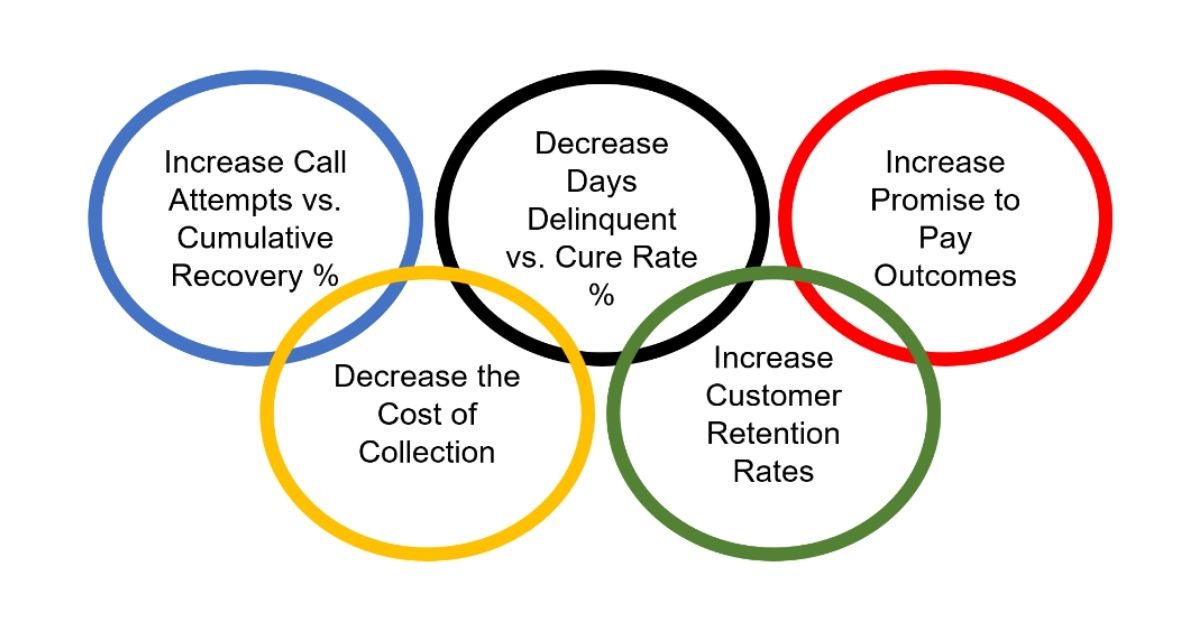

Multiply Debt Recovery Results

Understanding your Customer is a fundamental tenet of lending and credit business. We may be under the impression that we know our Customer(s) quite well, however Decision Science challenges that impression with hard evidence which can surprise. The important question is, “how do we corroborate and improve on our experience

Beyond B.a.U Budgeting & Planning.

After months of improvising, CFOs recognize that they need real budgets for 202X to match resources with scenarios & strategy. They also realise that the business-as-usual budgeting process, with its traditional inputs & standard approaches, is no longer suited for the purpose. Organizations who use the typical budgeting process, whether

Collect Safely! Safeguard your Customers, Employees and Agents.

18 months ago few would have imagined that a crisis would bring the World to its knees due to a Pandemic. Unlike previous crises where macroeconomic developments played out over a few months, there was a sudden disruption in economic activity as lockdowns were announced. Overnight, it was about prioritizing

Information Management & Notifications during an Emergency.

As per global risk reports on current threats, a threat likelihood and its impact have added a new dimension to the concept of urgency & emergency. From the COVID-19 pandemic to the situations like civic unrest, cyber-attacks and geo-thermal disturbances, all examples lead to one conclusion; these chaotic situations severely

Energize Collections with ENCollect

A steady Inflow of Principal and Interest (Profit) is the fuel needed to keep a Lending Institution in business. Debt Collection is at the heart of this. It is without doubt that in present circumstances a $ recovered is perhaps as or more valuable that a $ of new business.

Online Workshop on Business Continuity Management with RIMAN and Central Bank of Nigeria – 15th December 2020.

Total RegTech is pleased to announce our participation on a full day online training on Business Continuity Management organised by the Risk Management Association of Nigeria (RIMAN) & Central Bank of Nigeria on the 15th of December 2020. Topic: Putting Business Continuity into Practice in your Organisation Organisers: Qazique, RIMAN, Central Bank

Half-Day Workshop on the Examination of Risk Models applied in Credit Risk Rating, Basel, IFRS9, ICAAP and IRRBB for African Regulators.

Conducted On 9th December 2020. Total RegTech Solutions is pleased to announce the completion of a half-day workshop on the Examination of Risk Models applied in Credit Risk Rating, Basel, IFRS9, ICAAP and IRRBB. This event was organised by FITC, Nigeria in collaboration with the Central Bank of Nigeria. This

Regtech AFRICA partners Total RegTech Solutions

Regtech Africa, an emergent global digital tech media platform with a niche focus on regulatory technology innovations in Africa and around the world has announced a strategic partnership with Total RegTech Solutions, a CRG firm with proven track records and cutting edge solutions to improve business productivity. With the partnership